The White House returned on Friday with a number of options to help borrowers, just hours after the Supreme Court invalidated the president’s plan to cancel student loans.

Failure of Student Loan Forgiveness

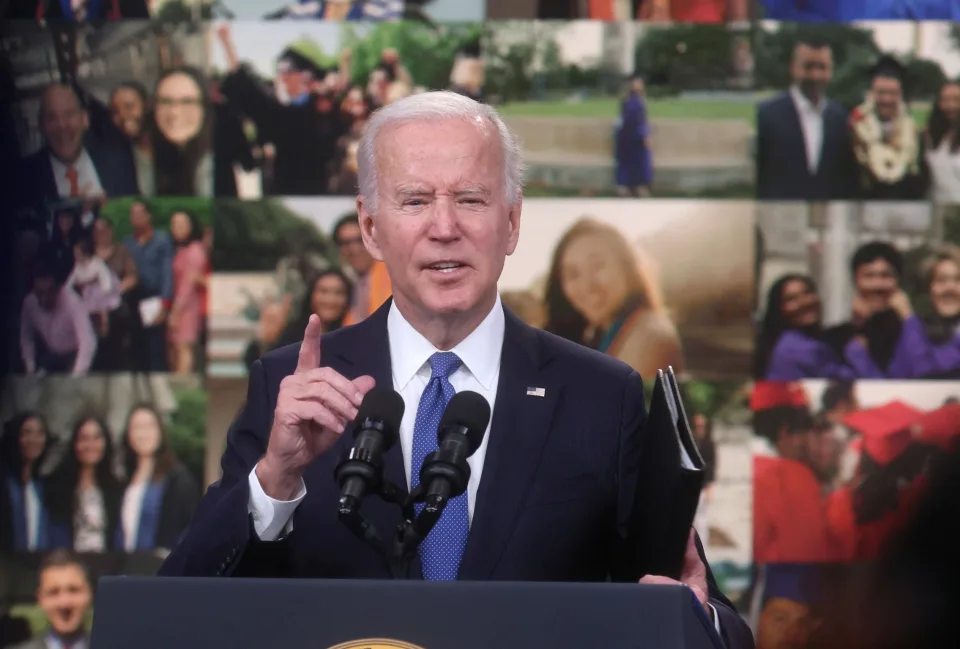

At a press conference on Friday, President Joe Biden said that the decision of the Supreme Court to cancel the student debt was a mistake reported by Yahoo! Finance.

Under the Higher Education Act of 1965, the Biden administration started the regulatory procedure to offer debt relief. The Education Department is also establishing a temporary 12-month on-ramp repayment plan that will eliminate the risk of default if borrowers skip payments once repayments resume in October. A new income-driven repayment strategy that the government dubbed “the most affordable repayment strategy in history” was put into effect.

According to a White House fact sheet, the Education Secretary started a rule-making process on Friday to offer options for debt relief for as many working and middle-class borrowers as possible using the power granted under the Higher Education Act. The Education Department on Friday published a notice informing interested parties of a virtual public hearing on July 18 and requesting written opinions for debt relief. Following the hearing, the agency will resolve any outstanding problems and hold negotiated rule-making sessions this fall.

If the Biden administration is pursuing the same option for debt relief that the court rejected, it is unclear from the White House factsheet. The federal government intended to waive $10,000 under that proposal for people making less than $125,000 and for households making less than $200,000 each year. The option for debt relief for people who obtained need-based Pell Grants is increased by $10,000. An email seeking clarification of the debt relief limitations the White House press office was pursuing under the Higher Education Act did not receive a prompt response.

READ ALSO: Without Using Reserves, California’s New Budget Closes A $32 Billion Indebtedness

Presentation of the Options to Reduce Debts

In addition, the administration presented a strategy to assist borrowers when they resume their payments that had been suspended in October. Borrowers won’t be penalized for missing, late, or partial payments for a full year. Borrowers can apply for the program without taking any action. The interest will continue to accrue throughout the 12-month term and be due, but it won’t capitalize at the end of the on-ramp period. Missed payments by borrowers won’t be recorded to credit bureaus, won’t be viewed as in default, and won’t be sent to collection agencies. However, borrowers who can afford to make their payments were urged to do so by the government.

Finally, the Saving on a Valuable Education (SAVE) plan was completed by the government. According to the White House, this new income-driven repayment strategy will reduce monthly payments for borrowers by half, enable many of them to make no payments at all and stop balances from increasing as a result of unpaid interest.

Here are the approaches to reducing their amount of debt:

- Borrowers can now pay up to 5% of their discretionary income toward their undergraduate loans, down from 10%.

- No borrower will be required to make a monthly payment if their income is less than 225% of the federal poverty threshold.

- If the initial loan balance was $12,000 or less, then the remaining balance will be forgiven after 10 years of payments as opposed to 20 years.

- The balance won’t increase if borrowers complete their payments, even if that monthly payment is $0 since their income is low because they won’t be assessed with unpaid monthly interest.

Before monthly payments resume this fall, student borrowers in repayment can enroll later this summer. Borrowers who sign up for the Revised Pay as You Earn (REPAYE) plan or who are currently engaged in it will be automatically enrolled in the new plan.

In a news release, Education Secretary Miguel Cardona said in a news release that “President Biden, Vice President Harris, and I will never stop fighting for borrowers,” adding that “we are using every tool available to provide them with needed relief.”

READ ALSO: Debt Of More Than Half Of The Developing Economies Is Unsustainable