In the week in which the Chinese real estate colossus is on the verge of a demolition that the Xi Jinping Government wants to control, the main indices have taken a breath of the corrections that they had been starring in. The Ibex, with 1.28%, became the most bullish thanks to the comeback in tourism.

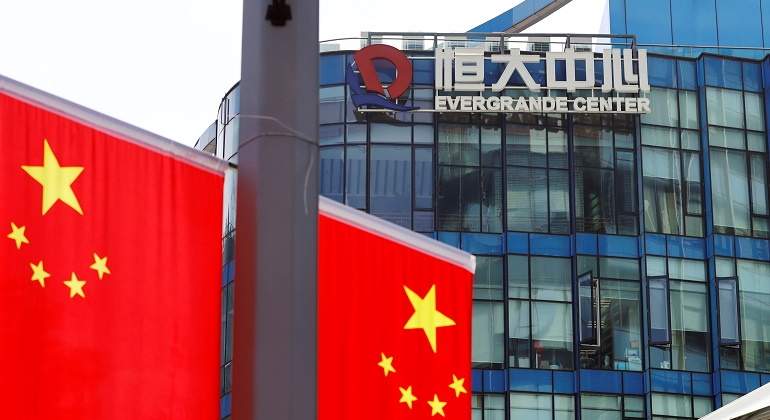

If investors expected a strong reaction from the Chinese authorities to the collapse of the real estate colossus Evergrande, they have found a great wall of silence. This week the tension had been unleashed before the imminent maturity of several bonds of the company, some denominated in dollars and aimed at international holders.

The supposed agreement that the signature would have reached with the creditors of its issuance in yuan, of which the fine print is unknown, had given little hope that something similar could happen with the dollar bond. But the deadline for the payment was fulfilled this Thursday and a 30-day grace period is now open to renegotiate the conditions.

This caused a drop of 11.6% in the company’s price on Friday, which seems hopelessly doomed to bankruptcy as orderly as possible, although without lights and stenographers. At least that would be what the authorities of the Asian giant intend, which, according to The Wall Street Journal , would have asked local governments and agencies to take measures to manage Evergrande’s real estate assets at a regional level, that is, to finish building the properties. residential buildings for which many citizens have already paid and try to appease social discontent in this way.

The Chinese government has not yet made an official statement but some measures indicate that it takes the financial impact of this matter very seriously. The Central Bank of China has declared that all operations with cryptocurrencies are illegal and has prohibited their circulation in the market, just as the National Development and Reform Commission has also prohibited the mining of crypto assets, preventing the use of domestic energy with this. end. Coincidence or not, the idea it conveys is that the Xi Jinping government does not want any surprises in what appears to be a controlled demolition of Evergrande.

A demolition that, despite the ominous that it could mean a new Lehman Brothers on a global scale, has not permeated the markets, for now. On Friday, the effect of default was more noticeable, with falls of 0.87% in the EuroStoxx 50, 0.95% in the French Cac, 0.72% in the German Dax or a tiny 0.04% in the Ibex, but even so they ended the week rebounding 0.67% in the case of the main European index; 1.04% in the Cac, 0.27% in the Dax -which is also nervously experiencing the federal elections next Sunday in Germany- and 1.28% in the Spanish selective, thanks to yesterday’s comeback of tourism stocks such as Meliá (2.25%), Amadeus (2.08%), IAG (1.89%) and Aena (1.91%). The SP 500 was down 0.34% weekly, mid-session on Friday, while the Nasdaq was down 0.11%.

Beat the highs

Percentages that slow down the losses accumulated by the European indices in the month. “In order to remove the risks of witnessing a deepening of the correction of the last weeks, it is necessary that they manage to beat the maximums that they marked last week, whose breakdown would be a sign of enormous strength. We are talking about resistance such as the 4,215 points of the EuroStoxx 50. As long as this does not happen, we continue to think that it is hasty to claim victory and the risk of witnessing a broader and longer-lasting correction that could lead the EuroStoxx 50 to seek 3,800 / 3,900 points will continue to remain “, explains Joan Cabrero, advisor to strategy of Ecotrader, the investment portal of elEconomista .

The exclusion takeover launched by Otis by Zardoya this week , means that, if carried out, investors will lose one of the firms that best paid shareholders, since it has dedicated, on average, 92% of its net profit in the last 30 years to pay dividends. In Naturgy, whose takeover is partial , the minority can still scratch 2.5% in IFM’s takeover of the energy company.

On the other hand, after the Fed meeting, which at the end of the year indicated for the start of the withdrawal of stimuli, the market expects the first rate hike by the end of 2022. Bonds reflected this perspective with increases in the yield of the bonds. main references. The US 10-year climbed to 1.458%, while the German bund stood at -0.228% and the Spanish bund reached 0.409%, a level that it had not seen since June.